high iv stocks barchart

Barchart Free Features For fundamental investors. We can use Barcharts Stock Screener to find other stocks with high implied volatility.

Plain Brown Paper Texture By Stock Pics Textures On Deviantart Brown Paper Textures Paper Texture Brown Texture

Market Data powered by Barchart Solutions.

. Options serve as market based predictors of future stock volatility and stock price outcomes. The underlying was 108 when I sold the call and 131 on the day I got assigned. Get short term trading ideas from the MarketBeat Idea Engine.

Over 47000 contracts traded Friday in the April 9 calls. The level of the implied volatility of an option signals how traders may be anticipating future stock movements. Whats Included In order to be included.

A high IV Percentile means the current IV is at a higher level than for most of the past year. The totals are added up for strength and direction depending on the buy sell and hold ratings and those ETFs within the top 1 bracket are listed in these pages. Get daily stock ideas top-performing Wall Street analysts.

The only winning trade investing 10 with high IV Rank resulted in a 3 return over 11 years and that does not include commissions. 10 or 15 minute delay CT. Exploring Graf Acquisition Corp.

But what we can do is point you to a list that updates every day. Market sector and world indices. Call Options Top Gainer.

Which Stocks Have the Highest Option Premium. Call Option Most Traded. High iv stocks barchart.

This would occur after a period of significant price movement and a high IV Percentile can often predict a coming market reversal in price. Option premiums change every second so we cant make an evergreen list. Low Put Call Ratio Volume.

The current IV compared to the highest and lowest values over the past 1-year. Interest rates and dividends are easily found by doing a google search. Unusual call buying is characterized by much larger than normal volume that dwarfs the open interest and spikes the implied volatility or IV.

Dealer Tip For Identifying Debits Credits Financial Statement College Adventures Lettering. Stock Ideas and Recommendations. The only unknown is implied volatility.

Ordinarily I like IV to be 50 and IVR current IVs level relative to where its been for the past 52 weeks to be. Since the price of an option is the same as its premium this list provides options with the highest. Option chain with implied volatility data.

Get daily stock ideas top-performing Wall Street analysts. NFLX 56 8 GG 53 9. Volume reflects consolidated markets.

I was thinking about rolling it into next year to collect a little more premium and delay the capital gain Ive held the shares for while. High Put Call Ratio Volume. The reason for these poor trading results is most likely because as IV increases so does directional risk.

I collected a premium of about 45 a share. High IV or Implied Volatility affects the prices of options and can cause them to swing more than even the underlying stock. View GFORUs stock price price target earnings forecast insider trades and news at MarketBeat.

Implied volatility is just another way to say the price of the option. A green implied volatility means it is increasing compared to. After commissions it also lost money.

High PCR Open Interest. Implied Volatility IV The first five are known. View which stocks are hot on social media with MarketBeats trending stocks report.

How High Dividend Stocks Steadily Outperform The Rest Of The Market Dividend Dividend Stocks Financial Markets. Signal strength and signal direction are independent of the signals rating. Options IV rank sorter.

View which stocks are hot on social media with MarketBeats trending stocks report. The Option IV Rank and IV Percentile page shows equity options with the highest daily volume along with their at-the-money ATM average IV Rank and IV Percentiles. Fundamental data including income statement balance sheet SEC filings.

News and headlines on individual symbols. The strength and direction ratings are listed in the advanced opinion pages. You can look at your trading screen and see the stock price strike price days to expiration.

Lets run the stock screener with the following filters. Most Traded by Value. Implied Volatility PCR OI PCR Vol Contracts Close Change Open Interest Reading Option Chain.

Therefore there is no advantage to selling high IV the way that. Call Option Open Interest Change. Stock Ideas and Recommendations.

15 20 minute delay Cboe BZX is real-time ET. You may see a rise in implied volatility prior to an announcement with a sharp drop-off in implied volatility afterwards. Fundamental data provided by Zacks and Morningstar.

Market an option needs to have volume of greater than 500 open interest greater than 100 a last price greater than 010 and implied volatility greater than 60. The expiration was Oct 15 with a strike price of 115. By understanding both IV and IV rank you can determine the true nature of a stocks volatility.

Get short term trading ideas from the MarketBeat Idea Engine. It highlights Stocks ETFs and Indices with high overall callput volume along with their at-the-money Average IV Rank and IV Percentile. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio.

SLW 52 Naturally we are coming into earnings season here so theres a reason that some of these have high IV here eg NFLX announces in a week and a half. Stocks can naturally move up and down on their own depending on certain market conditions and under those natural market conditions you can trade options and make a nice profit. Call Options Top Loser.

Displays equities with elevated moderate and subdued implied volatility for the current trading day organized by IV percentile Rank. Aspect Ratio Image Wikipedia The Free Encyclopedia Anamorphic Aspect Ratio Ratio. Simply put implied volatility is the price of an option.

Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. Friday saw very heavy unusual call buying in the ERIC April 9 calls. Most Traded by Volume.

As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account. If IV Rank is 100 this means the IV is at its highest level.

Relationships Campus Network For High Availability Design Guide Cisco Design Guide Networking Campus

Dividend Stocks Are The Worst Meb Faber Research Stock Market And Investing Blog Optiontradingforaliving Stock Options Trading Stock Options Dividend Stocks

Watchlist Option Alpha Option Trading Implied Volatility Ishares

30 Year Gold Price History In Uk Pounds Per Ounce Gold Price History Gold Price Gold Price Chart

How High Dividend Stocks Steadily Outperform The Rest Of The Market Dividend Dividend Stocks Financial Markets

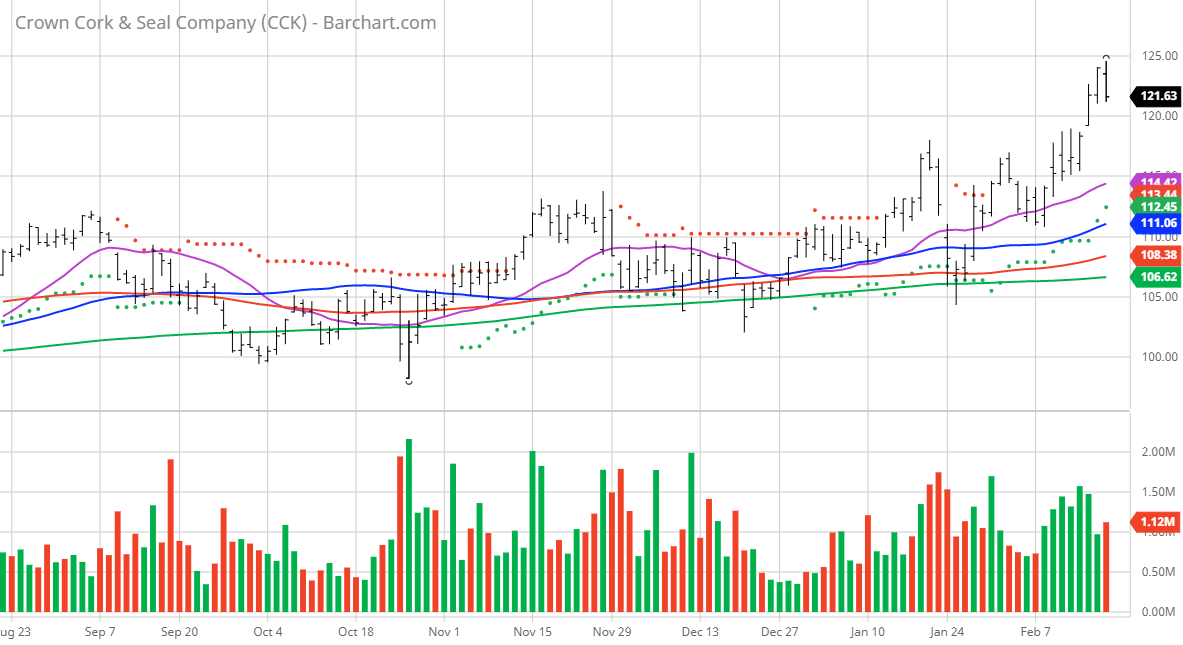

Chart Of The Day Crown Holdings All Time High

Best In Economics This Week November 21 Economics Week Management

Michael Hart On Twitter Options Trading Strategies Option Strategies Trade Finance

Pin By Hak Wan On 2017dowmarch Red Roses Trending Elliott

Best In Economics This Week November 21 Economics Week Management

Pin By Ace Trump On Tastytrade Statistics Implied Volatility Option Trading Investing

Download Aplikasi Nilai Kkm Secara Otomatis Microsoft Excel Pendidikan Microsoft Excel Guru

Quality Management Ppt Powerpoint Presentation Slides Management Powerpoint Templates

Din A3 Technical Drawing Format And Folding Technical Drawing Drawing Sheet Samsung Galaxy Wallpaper

Bulbasaur Color Palette Color Palette Bulbasaur Chart

Google Meet Shows Up In Gmail Inboxes A Few Years Too Late Techcrunch Gmail What Might Have Been Best Insults